If you have a family or dependents, ensuring that they are taken care of if something happens to you is at the top of your priority list. At Morin Insurance, we understand the stress that uncertainty can bring, which is why we work with all our customers to ensure they have the coverage they need. One of the ways you can provide for your loved ones is with permanent life insurance in NH.

But what is permanent life insurance, and how does it differ from other types of coverage? Let’s find out.

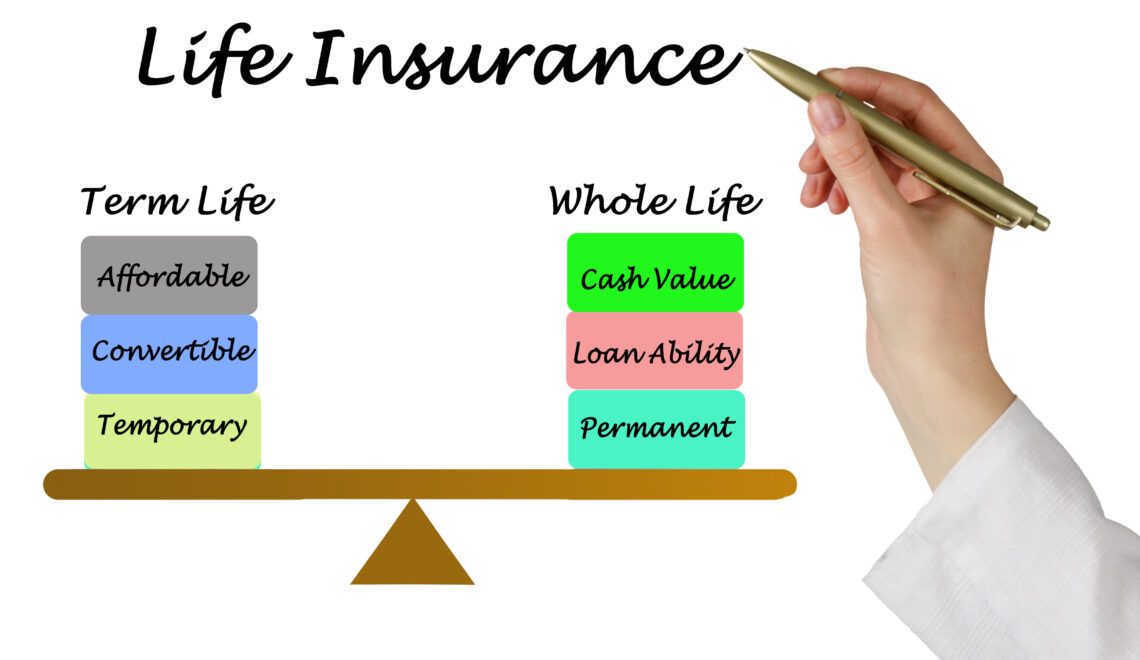

Permanent vs. Term

Permanent life insurance is a type of life insurance that provides coverage for the entire lifetime of the insured person. The requirement is that the policyholder continues to pay the premiums. Unlike term life insurance, which provides coverage for a specific term (e.g., 10, 20, or 30 years), permanent life insurance does not expire as long as you continue to pay the premiums.

Features of Permanent Life Insurance

- Lifetime Coverage: As mentioned, permanent life insurance provides coverage for the entire lifetime of the insured as long as premiums are paid.

- Cash Value Accumulation: One distinguishing feature of permanent life insurance is the accumulation of cash value over time. A portion of the premium payments goes into a cash value account, which grows on a tax-deferred basis. Policyholders can borrow against or withdraw from this cash value, though doing so may affect the death benefit.

- Premiums: Premiums for permanent life insurance are typically higher than those for term life insurance. However, they remain level throughout the life of the policy.

- Death Benefit: Permanent life insurance provides a death benefit to the beneficiaries upon the death of the insured. This amount is typically income-tax-free for the beneficiaries.

Types of Permanent Life Insurance

There are different types of permanent life insurance. The two main categories are whole life insurance and universal life insurance. Whole life insurance provides a guaranteed death benefit and fixed premiums. Universal life insurance offers more flexibility, allowing policyholders to adjust premium payments and death benefits within certain limits.

Permanent Life Insurance NH | Morin Insurance Agency

Our agents at Morin Insurance are dedicated to serving our customers and providing them with the coverage they need. If you are looking for a reliable way to provide for or protect your family should the worst happen, permanent life insurance in NH may be the solution.