So you’re at the stage in life where you’re ready to purchase life insurance to protect your family in case of an accident. The best thing you could do is prepare your life insurance in New Hampshire. While it can be stressful to think about, it can be a great way to support your loved ones who depend on your income.

It can help cover funeral expenses and debts and manage day-to-day life until they get back on track. You can do a few things to make sure you choose the right plan and coverage that you need. Morin Insurance is here to discuss it with you today.

Investing in Life Insurance in New Hampshire

First things first, there are a few things to know about life insurance before taking out a policy. The younger and better your health is, the lower your premiums usually are. Therefore, it can be a good idea to invest early and lock in a price now. The best way to gauge how much life insurance you should carry depends on debt.

Ideally, a policy will cover any remaining cost on a home mortgage, student loans or cover your income for a few years. This will help your loved ones take over those costs with ease and not have to worry about repaying them.

Different Type of Policies

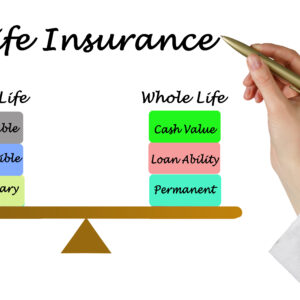

Of course, there are different types of life insurance policies in New Hampshire. There are either term or cash value insurance. Term life insurance has low premiums in your younger years but does not build up a cash value over time. Whereas cash value life insurance can follow the guidelines of either universal or variable life insurance. Here at Morin Insurance, we can assist you with choosing the right policy for your income and circumstances to keep you protected.

Morin Insurance

With Morin Insurance, as long as premiums are paid and no loans, withdrawals, or surrenders are taken, the total amount of the policy will be paid upon death. If you are looking for life insurance in New Hampshire, contact Morin Insurance for more information at (603) 875-1200 or email Info@MorinAgency.com.