Life insurance can be awkward or unpleasant to talk about. After all, no one wants to think about their own death. But it is unavoidable, and you want to know that your loved ones will be taken care of should something happen to you. At Morin Insurance Agency, our agents take the time to craft individual policies for each of our clients so you know that you are getting the best life insurance in NH for you and your family.

Do you have NH life insurance? Here’s why you should arrange yours instead of putting it off.

It always pays to plan ahead.

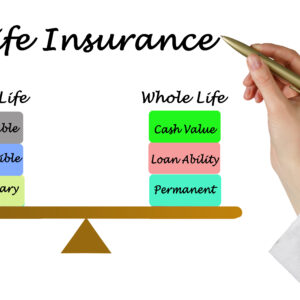

You never know what is going to happen. And if something happens to you, it’s your family that has to handle everything. Your family will have to deal with more than just financial concerns. But having money to cover unexpected expenses will certainly help. A life insurance policy is more than just an agreement that the insurance company will pay out a certain amount of money in the event of your death. You can allow for certain circumstances and plan for any eventuality.

Allot funds to particular uses.

To ensure that your family is protected and your affairs are in order, you can stipulate that your insurance payout is used for designated reasons. For example, if you have outstanding debts or want to pay for someone’s education, your insurance policy can reflect your wishes. As much as you love and trust your family, everyone has different priorities. You want to know yours are met even after you’re gone.

Select your beneficiaries.

In most cases, a life insurance policy will pay out to your spouse or next of kin. But you can name anyone as your beneficiary. If you have a particular relative or loved one who relies on you now, you can ensure that they have some financial security by including them as a beneficiary of your life insurance.

NH Life Insurance | Morin Insurance Agency

Planning for what happens after you die isn’t a pleasant thought, but our agents will help you craft your policy with care and efficiency. The good news is that after you have worked out the details of your policy, you don’t have to think about it anymore! You can relax and have peace of mind that you have taken care of everything the best you can.