No matter what stage of life you’re, NH life insurance is a must. Providing benefits to both you and your loved ones, life insurance brings peace of mind. In this article, we’ll provide you with some of the financial concerns that come with the many changes you may face during life. As well as how your life insurance plays a role in each stage.

for the college graduate

After college, you will more than likely have debt. Although federal student loans may be discharged after death, private student loans, that someone co-signed for will not. The same holds with other debt that’s cosigned; such as auto loans and credit card debt. With New Hampshire life insurance, you can alleviate the financial burden from those you love.

for newlyweds

As a newlywed, you have new financial responsibilities. Chances are, these new responsibilities are based around combined incomes. That means without you; your spouse may not be able to handle the financial responsibilities alone.

The loss of a loved one is traumatic in itself, without the stress of having to save your home. Considering long-term requirements in the case of accidental death is a must. Death benefits obtained at this stage of life are likely to have increased from your college days as your financial responsibilities are more significant, and your salary is increased.

For New parents

When you add children to the equation, you create an ever-changing list of financial responsibilities that need handling; whether you are there or not. From pre-school to college tuition, diapers to first cars, the financial obligation of parents is mind-numbing. Thus, when a wage-earning spouse passes away, he or she leaves the living spouse with the stress of covering these expenses. Many couples take out additional, term life insurance, policies to help them get through these years.

For the Pre-retiree

As a pre-retiree, you’re positioning yourself for the future. Reducing debt and saving into your retirement fund become a top priority. However, what happens if you pass away during this time? Can your spouse handle the repayments and post-retirement expenses without the income that would have come over the next few years? Chances are, they will need as much help as they can get. Life insurance death benefits can give them that help.

for the Retired

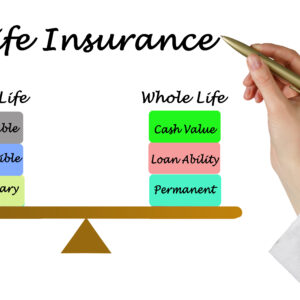

Your retirement savings are a limited pool of funds that you likely won’t be adding to after retirement. Depending on how the funds are invested, you could even end up losing some of your savings. An NH life insurance policy can create the legacy you envision without aggressively spending your savings. Besides, life insurance policies can be used for tax-free loans during retirement. Although any portion of the loans that are not repaid before death can reduce the overall death benefit. Finally, life insurance proceeds are typically exempt from probate.

While your need for NH life insurance will ebb and flow, it is always present. By securing a policy while you are young and in good health, you can have lower premiums for the remainder of your life. As living expenses increase, you can supplement your whole life policy with a term policy that covers you during the years that debt peaks. No matter how you decide to structure your life insurance plan, the ultimate truth is that you coverage at every stage. Contact our team today at 866-538-2544 for your free NH life insurance quote.