Purchasing life insurance is one of the most selfless acts one can take. Although New Hampshire life insurance provides peace of mind, there are generally several questions that arise. Thus, choosing the right type of life insurance for your needs (and budget) can quickly become an overwhelming task. For instance, do you know the differences between term, whole, and universal life insurance policies? Most don’t.

Lucky for you, the team at Morin Insurance Agency is here to set the record straight.

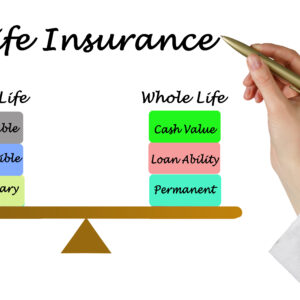

Term life insurance.

As one of the most popular choices for life insurance in New Hampshire, it’s imperative to understand a term policy. This type of coverage lasts for a specific amount of time, referred to as the ‘term.’ Typically, term life is the most budget-friendly offering when it comes to the monthly premium. Even though the premium is lower, should the policyholder pass during the specified time period, the death benefit is paid in full to the stated beneficiaries.

Whole life insurance.

Another popular choice for life insurance is whole life. This type of coverage provides the policyholder with permanent coverage that accumulates cash value over time. Often, whole life is used not only for life protection but also as a means of retirement savings (not the highest returns, but it is an option)!

It’s crucial to note that upon signing your policy, a projected forecast is provided. Please note that at some point, the cash value will peak and then decline. Once this happens, the cash value may be withdrawn – often for far less than the death benefit. If you do withdraw, your coverage will also end. For most, meeting with an advisor is the best route. This allows you to discuss your financial situation, goals, and long-term outlook for coverage requirements.

Universal life insurance.

And then, there is one of the most complicated policies – universal life. This coverage allows an excess of premium payments, above the cost of the insurance, to be credited towards the cash value. The main difference between a universal and whole life policy is that the cost is not guaranteed and your cash value may become exhausted without careful monitoring.

When starting out, choosing life insurance in New Hampshire can be complicated. However, it’s a must that every individual should consider. Although we pass on, we leave behind loved ones. Knowing these same loved ones won’t have financial burdens on top of heartache is priceless.

For more information on New Hampshire life insurance, please contact our team at Morin Insurance Agency by calling (603) 875-1200.